April 2024 Market Update

Population growth fuels a hot start for Calgary

This month, we have some incredible news to share regarding Alberta’s population growth relative to the rest of the country, the effects of which have shifted Calgary’s real estate market into top gear several months earlier than expected.

Tight supply levels we typically only see during the peak summer months have pushed prices higher for two months in a row now, going up by over $12,000 in each of February and March 2024. How is it that this can keep happening month after month? What is it that is driving all this market activity? The survey results are in and the population growth numbers provided by Statistics Canada explains our incredibly hot market conditions.

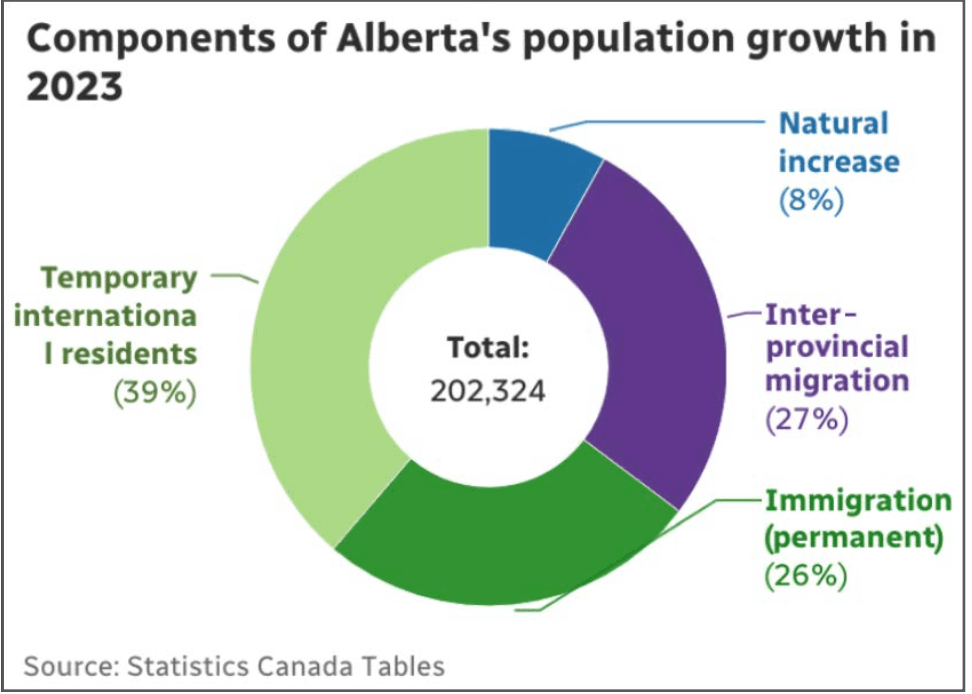

Statistics Canada reports that Alberta is demonstrating unprecedented growth, adding over 200,000 people in 2023, with many of them choosing to settle down in Calgary. In fact, last year saw Alberta achieve the highest levels of interprovincial net migration ever observed by Statistics Canada since they began tracking this metric in 1972.

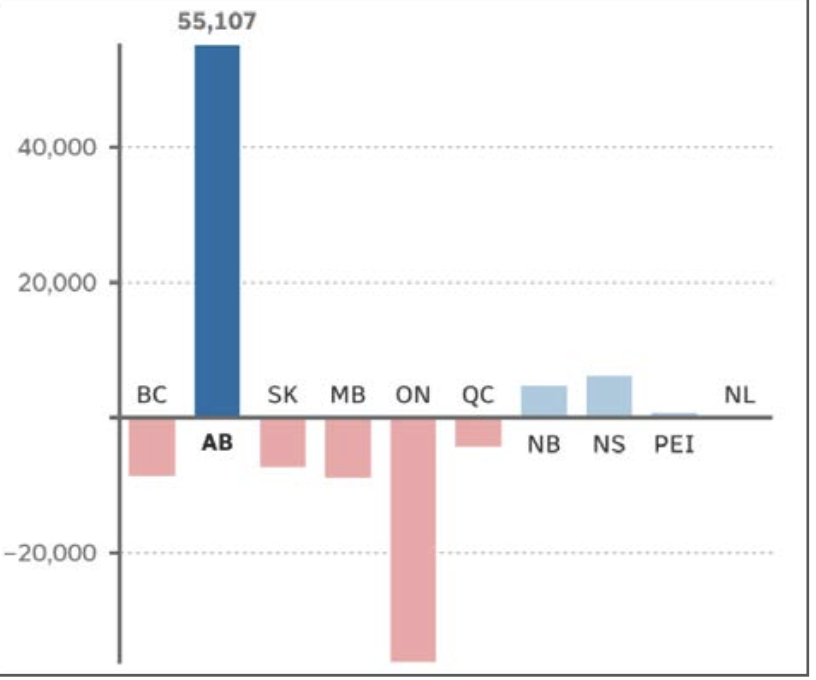

Wow! The numbers are startling, as Canadians seek refuge from the insanely unaffordable markets of Vancouver and Toronto, each of which have average prices of over $1 Million.

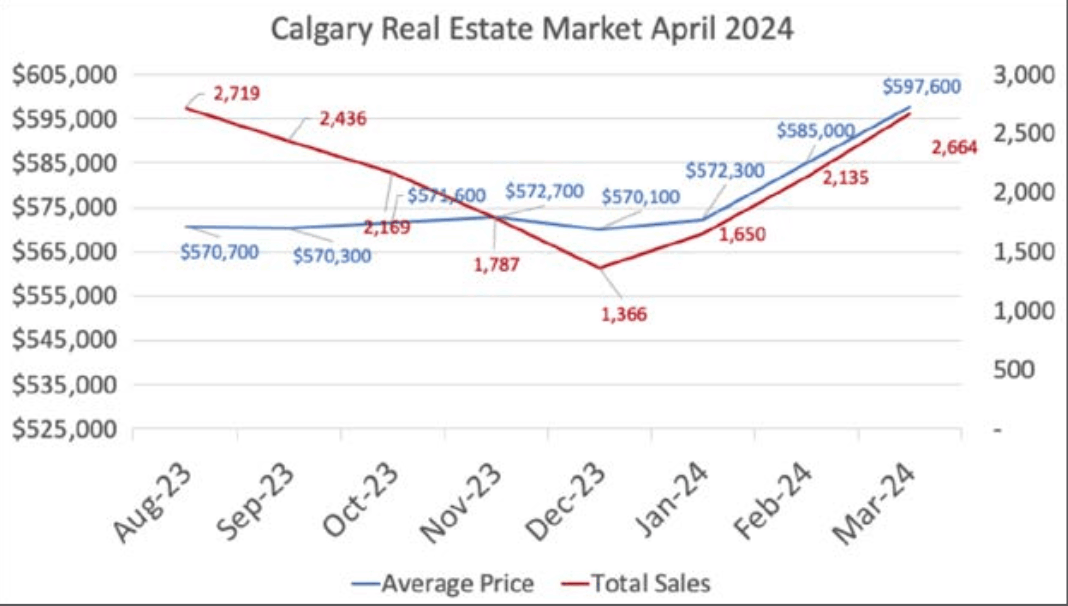

This incredible population growth has pushed up demand for real estate in Cowtown, bringing the average price of a piece of real estate in Calgary to $597,600 at the end of March, up from $585,000 in February.This marks the second month in a row that we’ve seen 5-figure increases, both of which are up by over 10% from last year.

This is a sharp upward adjustment from what was a very tame fall and winter, when prices stayed pretty close to the $570,000 mark between August 2023 and January of this year. But Calgarians would now need to pay 5% more that figure already, just three months into the new year. Quite the jump!

Sales have also picked up, with 2,664 sales taking place in March. We’ve not seen those numbers since last August, which has driven down the available supply and correspondingly the Months of Supply metric most commonly used to evaluate whether we are in a buyer’s market or a seller’s market.

As you can imagine we are very much in seller’s market territory, as we have been for over a year now. In fact, we can now say that we have the tightest conditions our market has seen since 2006, with less than one month of supply available for buyers to choose from!

We would have expected these tight conditions closer to the peak selling months of May, June & July, so to see it occurring in March is a strong indication that we will have very tight conditions throughout the busy summer selling season.

Why is this happening? Well, it is simple supply and demand. Alberta is positively booming, growing by over 200,000 people in 2023, by far the most of any province in the country. In fact, most provinces in Canada are losing people because they are moving to Alberta! Check out the graph below, which tells a profound story – Alberta is indeed the #1 destination for all Canadians contemplating a move and, as the largest city in Alberta, Calgary has seen many newcomers arrive needing housing.

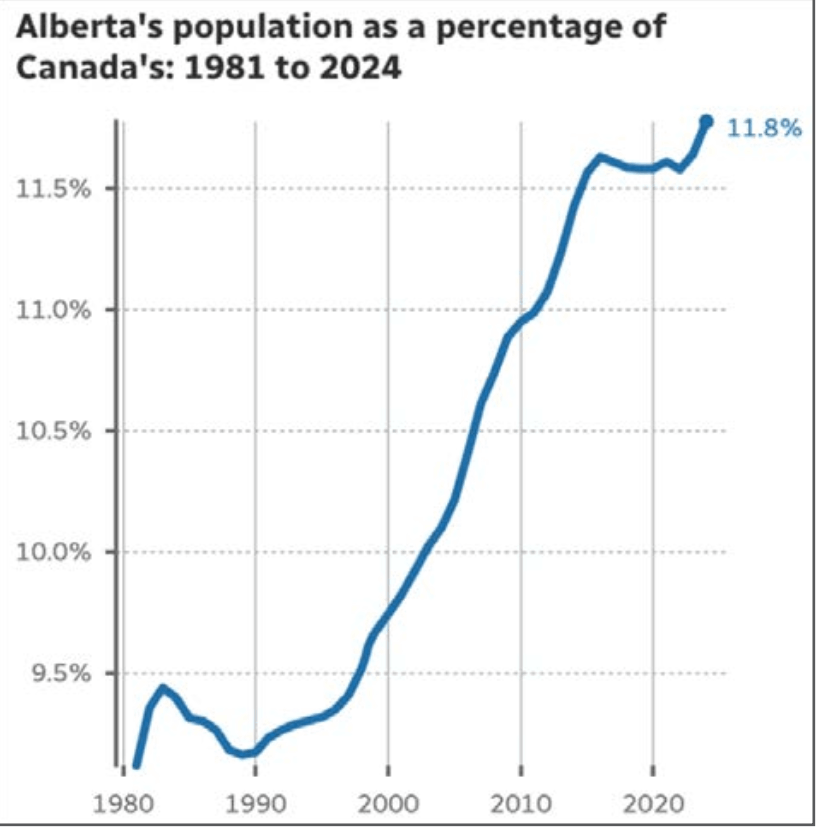

Alberta’s relative affordability is certainly playing a large part, given the high prices consumers have to pay for housing in Vancouver and Toronto. What’s interesting is that Alberta has now regained its growth trajectory that it gave up during the economic downturn between 2015 and 2020, as we continue to increase our overall share of the Canadian population, recently reaching a record high of 11.8%. Go Alberta!

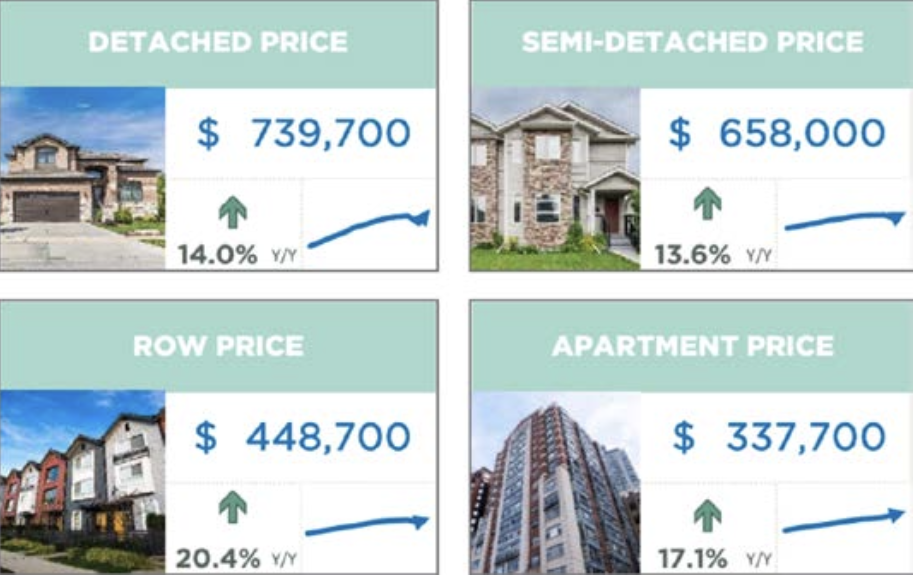

Breaking things down a little more closely, we have seen price increases across all segments...

Detached pricing is now at $739,700, Semi-Detached is at $658,000, Row Townhouses are just under $450,000 and Apartment condos are approaching $340,000.

Increasing prices are symptoms of a more concerning trend, however, which is the low new listings-to-sales figures we saw last month. Taking a look at the graph, below, you can see a stark difference when this year’s numbers are compared to last year.

Sales are up by about 10%, however new listings are actually down by 4%. The combined effect has resulted in sales actually outstripping inventory, something that we haven’t seen at all in the last 12 months of trading.

So, if you are a buyer looking to get into the market, is there any relief in sight? Well, to make things a little easier it is now widely expected by most economists in Canada that the Bank of Canada will begin cutting the key lending rate this spring or summer, with both CIBC and the British Columbia Real Estate Association forecasting rates to start coming down gradually beginning this month.

This is good news for

anyone seeking to qualify for a new purchase, but also for existing homeowners with a variable rate mortgage. In fact, because of this widely held belief that we will start to see rates coming down, we feel that anyone who is about to take on a new mortgage or renew an existing one should strongly consider going with a variable rate mortgage product for their next loan, given the general acceptance that rates will start to trend downwards from this point forward.

In local news, Calgary city council voted down a motion to take the proposed “blanket rezoning” changes to a plebiscite vote, instead deciding to go ahead with the planned public hearing.

This hearing, and the vote by council thereafter, is surely to be the biggest story in Calgary real estate this year, as city hall will decide whether or not to change the base level of zoning for all residential properties in Calgary from R-C1 to R-CG.

That would mean the number of allowable structures on a property would go from 1 to 4 – a big change. Because of changes made to the bylaw in previous years, a move to R-CG would also allow secondary suites in each dwelling unit, raising the total number of allowable units on a single parcel to 8.

A big difference for sure, but one that doesn’t seem so crazy especially considering that the federal government is trying to put pressure on provinces and municipalities to make this zoning change in order to access over $15B in funding for rental apartment construction, so Calgary is actually ahead of the game when it comes to proposing sweeping changes to the land use framework for development.

The public hearing happens April 22 and is part of a months-long process by the city to seek engagement and feedback from the public before taking the matter to a vote later this year. Now, we won’t go into too many details here, but if you would like to know more about the impacts of this proposed change you should definitely check out our YouTube channel, where we explain the changes in detail and also the results of the special hearing of council from last September, where they heard from the public and debated the merits of the proposal laid out by the housing affordability task force commissioned by the city in 2023. This is a contentious issue to be sure, and one you can bet we will be following closely as it develops.

Categories

GET MORE INFORMATION