June Market Update

**Calgary’s Market Stabilizes But interest rate drop may bring more buyers**

SPRING HAS FINALLY SPRUNG IN CALGARY, THE CITY IS GREEN AND SPIRITS ARE HIGH AS THE SUMMER approaches. May and June are typically the busiest months of the year when it comes to sales volume, and we are seeing that in 2024 with strong sales figures yet again. In May, Calgary observed 3,092 sales – the highest of the year so far. However, there are some signs that the Calgary market may have seen the majority of its anticipated price gains already, with pricing up just $3,000 from last month to an average sales price of $605,300, on the heels of a $5,000 increase the month prior.

Calgary follows a very consistent seasonal cycle, with sales volumes and pricing ramping up from January through to mid-summer, and we are seeing that same pattern in effect now.

**THE CALGARY MARKET IN MAY**

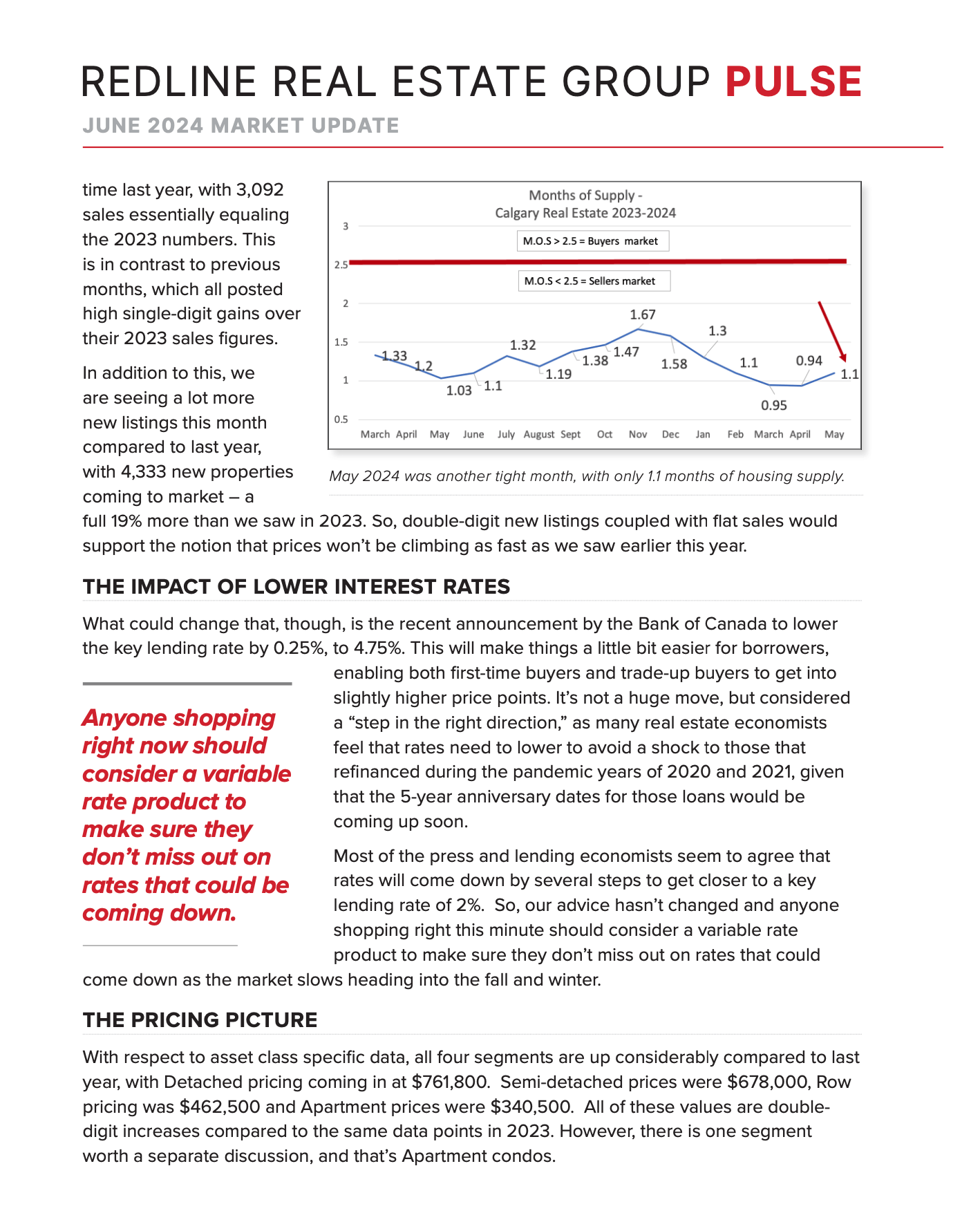

What’s been different in 2024 is that we’ve seen price gains coming earlier than we usually do. February, March and April saw pressure on the market that we typically only see in the late spring and early summer months, with Months of Supply coming in at 1.1, 0.95 and 0.94 respectively. This is in contrast to the same period a year before, when in 2023 we had Months of Supply coming in at 1.58, 1.33 and 1.2 between February and April.

So, the takeaway here is that Calgary got off to a very hot start in 2024 and might be peaking just a little earlier than we would usually expect.

There are a couple of other signs that support this theory, the first being the relatively flat sales growth from this time last year, with 3,092 sales essentially equaling the 2023 numbers. This is in contrast to previous months, which all posted high single-digit gains over their 2023 sales figures.

In addition to this, we are seeing a lot more new listings this month compared to last year, with 4,333 new properties coming to market – a full 19% more than we saw in 2023. So, double-digit new listings coupled with flat sales would support the notion that prices won’t be climbing as fast as we saw earlier this year.

**THE IMPACT OF LOWER INTEREST RATES**

What could change that, though, is the recent announcement by the Bank of Canada to lower the key lending rate by 0.25%, to 4.75%. This will make things a little bit easier for borrowers, enabling both first-time buyers and trade-up buyers to get into slightly higher price points. It’s not a huge move, but considered a “step in the right direction,” as many real estate economists feel that rates need to lower to avoid a shock to those that refinanced during the pandemic years of 2020 and 2021, given that the 5-year anniversary dates for those loans would be coming up soon.

Most of the press and lending economists seem to agree that rates will come down by several steps to get closer to a key lending rate of 2%. So, our advice hasn’t changed and anyone shopping right this minute should consider a variable rate product to make sure they don’t miss out on rates that could come down as the market slows heading into the fall and winter.

**THE PRICING PICTURE**

With respect to asset class specific data, all four segments are up considerably compared to last year, with Detached pricing coming in at $761,800. Semi-detached prices were $678,000, Row pricing was $462,500 and Apartment prices were $340,500. All of these values are double-digit increases compared to the same data points in 2023. However, there is one segment worth a separate discussion, and that’s Apartment condos.

Anyone shopping right now should consider a variable rate product to make sure they don’t miss out on rates that could be coming down.

May 2024 was another tight month, with only 1.1 months of housing supply.

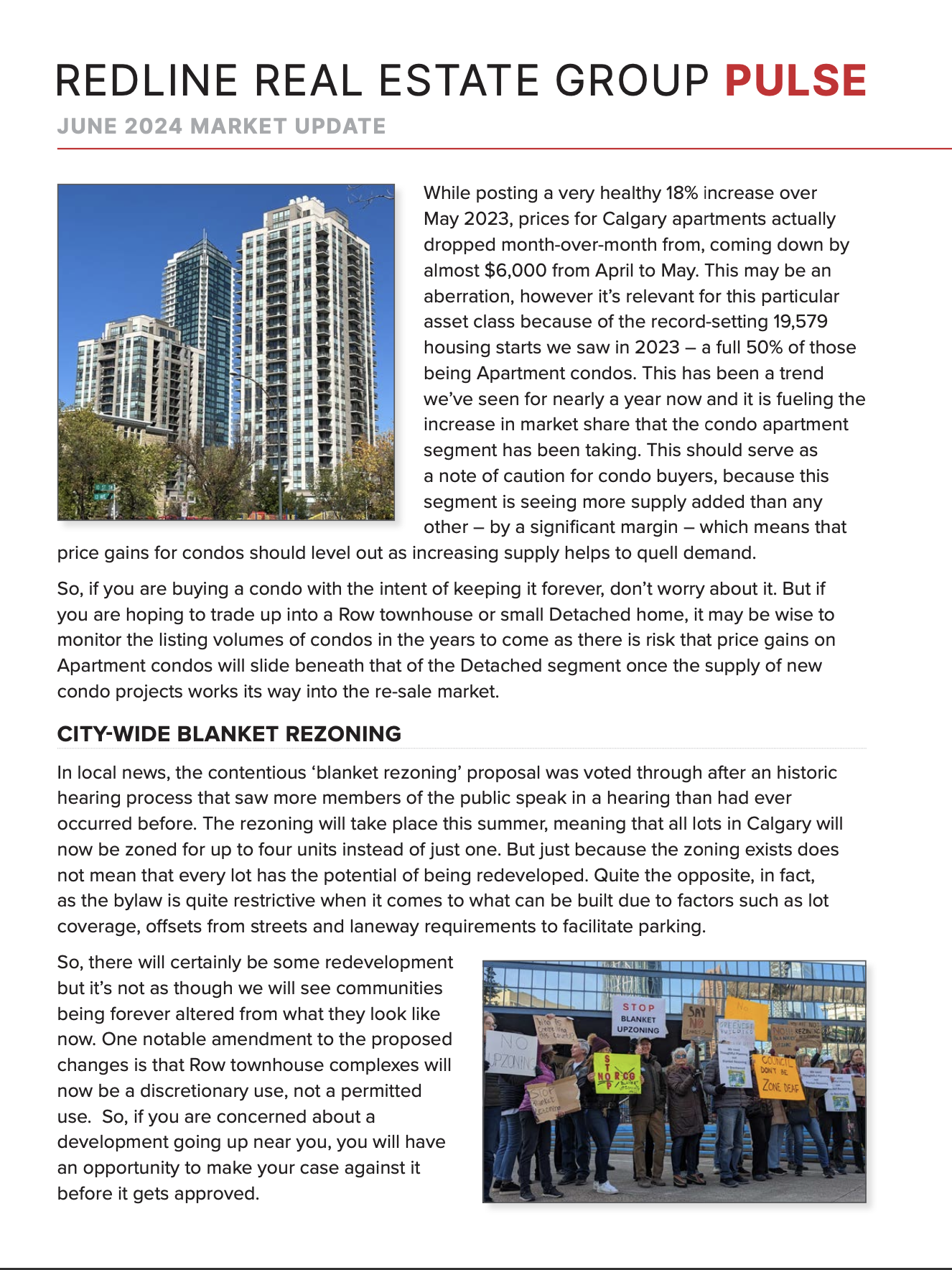

While posting a very healthy 18% increase over May 2023, prices for Calgary apartments actually dropped month-over-month from, coming down by almost $6,000 from April to May. This may be an aberration, however it’s relevant for this particular asset class because of the record-setting 19,579 housing starts we saw in 2023 – a full 50% of those being Apartment condos. This has been a trend we’ve seen for nearly a year now and it is fueling the increase in market share that the condo apartment segment has been taking. This should serve as a note of caution for condo buyers, because this segment is seeing more supply added than any other – by a significant margin – which means that price gains for condos should level out as increasing supply helps to quell demand.

So, if you are buying a condo with the intent of keeping it forever, don’t worry about it. But if you are hoping to trade up into a Row townhouse or small Detached home, it may be wise to monitor the listing volumes of condos in the years to come as there is risk that price gains on Apartment condos will slide beneath that of the Detached segment once the supply of new condo projects works its way into the re-sale market.

**CITY-WIDE BLANKET REZONING**

In local news, the contentious ‘blanket rezoning’ proposal was voted through after an historic hearing process that saw more members of the public speak in a hearing than had ever occurred before. The rezoning will take place this summer, meaning that all lots in Calgary will now be zoned for up to four units instead of just one. But just because the zoning exists does not mean that every lot has the potential of being redeveloped. Quite the opposite, in fact, as the bylaw is quite restrictive when it comes to what can be built due to factors such as lot coverage, offsets from streets and laneway requirements to facilitate parking.

So, there will certainly be some redevelopment but it’s not as though we will see communities being forever altered from what they look like now. One notable amendment to the proposed changes is that Row townhouse complexes will now be a discretionary use, not a permitted use. So, if you are concerned about a development going up near you, you will have an opportunity to make your case against it before it gets approved.

**END OF THE ROAD FOR EAU CLAIRE MARKET**

Calgarians will have one last look at the Eau Claire Market in early June as the building is set to be demolished this summer to make way for the Green Line LRT station that will reimage this historical plot of Calgary real estate for future generations. The station will be the northernmost stop on the first phase of the Green Line that will extend as far south as 130th Avenue SE when it is completed.

**STUDY TO EXPLORE CAR-FREE 17TH AVENUE**

17th Avenue SW is also making the news, as the City is launching a study to explore the possibility of closing the street to vehicle traffic in a pilot project for next summer, following the lead of other cities that have sought to preserve commercial / retail walkability in their established commercial corridors.

Our sales agents recently attended a conference in Banff where iconic Banff Avenue has been closed to vehicle traffic and it did lead to a more vibrant feel amongst the shops, bars and restaurants there, so this will be a curious development to watch and see if it comes together.

As always, everyone’s real estate situation is highly unique to them. Are you curious about what your property could be worth, or what it might cost you to move to an area you’ve had your eye on? We are always here to help and happy to get you the answers you need. So from all of us at Redline I hope you have an excellent spring and we will see you in a month’s time to kick off the summer.

Categories

GET MORE INFORMATION